-

OBP

- API

- API Collection

- API Tag

- API.Access Control

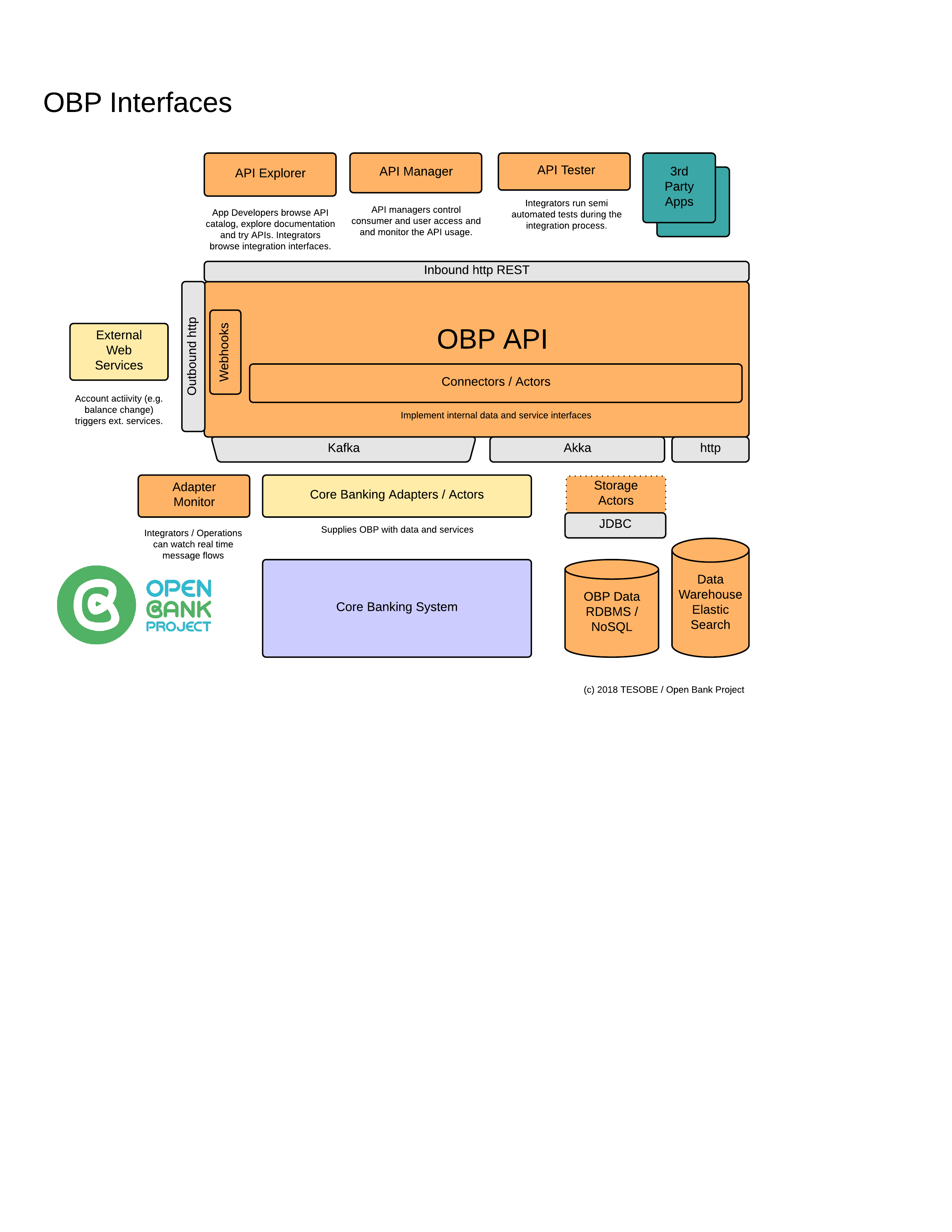

- API.Interfaces

- API.Timeouts

- API.correlation_id

- ATM.atm_type

- ATM.attribute_id

- ATM.balance_inquiry_fee

- ATM.branch_identification

- ATM.cash_withdrawal_international_fee

- ATM.cash_withdrawal_national_fee

- ATM.has_deposit_capability

- ATM.is_accessible

- ATM.located_at

- ATM.location_categories

- ATM.minimum_withdrawal

- ATM.name

- ATM.notes

- ATM.services

- ATM.site_identification

- ATM.site_name

- Account

- Account Access

- Account.account_id

- Account.account_routing_address

- Account.account_routing_scheme

- Account.iban

- Account.owner

- Account.queryTagsExample

- Adapter.Akka.Intro

- Adapter.Kafka.Intro

- Adapter.Stored_Procedure.Intro

- Adapter.authInfo

- Adapter.brand

- Adapter.card_attribute_id

- Adapter.card_attribute_name

- Adapter.card_attribute_value

- Adapter.card_id

- Adapter.card_number

- Adapter.card_type

- Adapter.cbsToken

- Adapter.cvv

- Adapter.expiry_month

- Adapter.expiry_year

- Adapter.issue_number

- Adapter.key

- Adapter.limit

- Adapter.name_on_card

- Adapter.offset

- Adapter.provider_id

- Adapter.serial_number

- Adapter.value

- Adaptive authentication

- Age

- ApiCollection.apiCollectionId

- ApiCollection.apiCollectionName

- ApiCollectionEndpoint.apiCollectionEndpointId

- ApiCollectionEndpoint.operationId

- Attribute.name

- Attribute.type

- Attribute.value

- Authentication Device (AD)

- Authentication.provider

- Available FAPI profiles

- Bank

- Bank.bank_id

- Bank.bank_id

- Bank.bank_routing_address

- Bank.bank_routing_scheme

- Branch

- Branch.branch_id

- Branch.branch_routing_address

- Branch.branch_routing_scheme

- CIBA

- CRL

- ChallengeAnswer.challengeId

- ChallengeAnswer.hashOfSuppliedAnswer

- ChallengeAnswer.suppliedAnswerExample

- Cheat Sheet

- Connector

- Connector Method

- ConnectorMethod.connectorMethodId

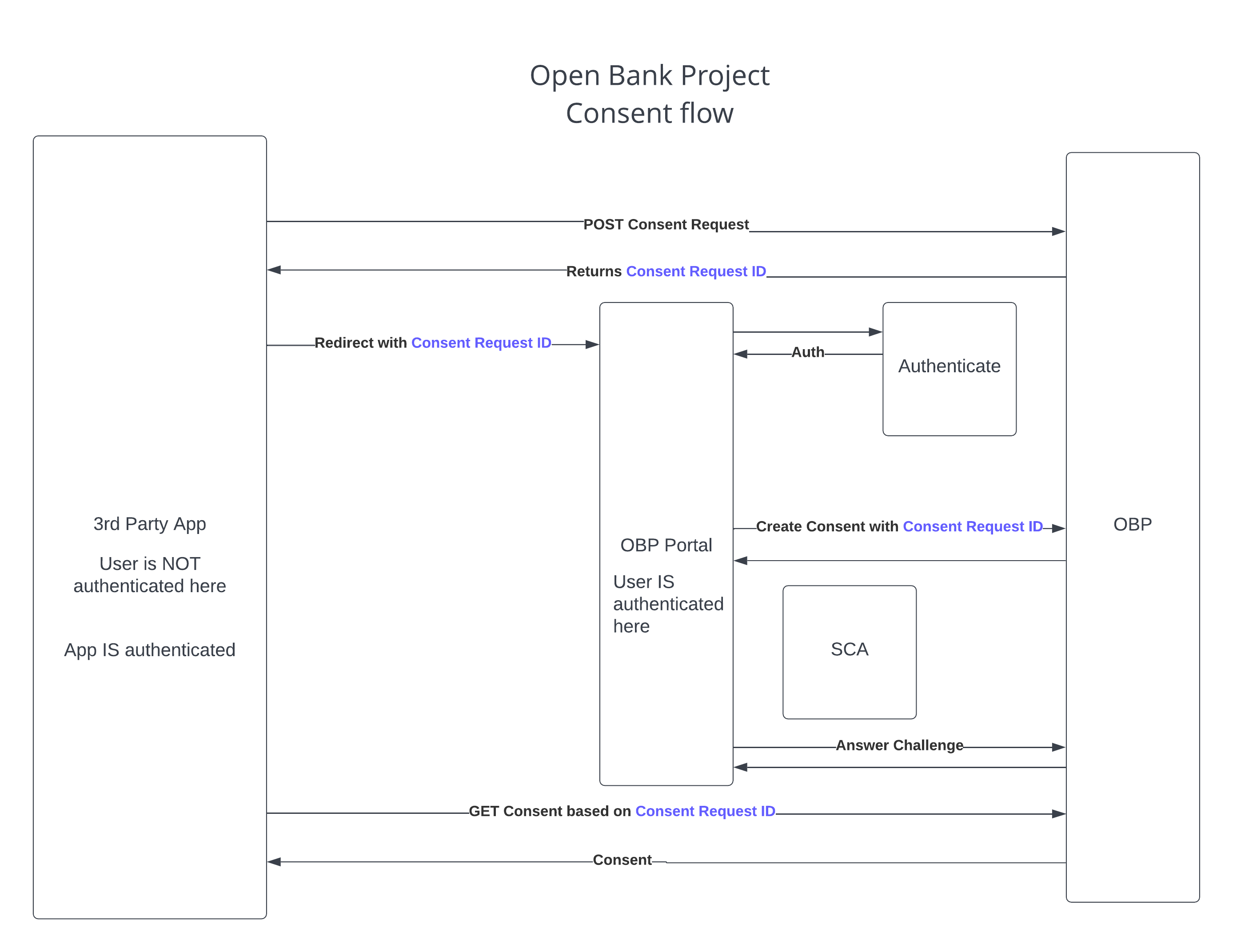

- Consent

- Consent / Account Onboarding

- Consent OBP Flow Example

- Consumer

- Consumer, Consent, Transport and Payload Security

- Consumer.consumer_key (Consumer Key)

- Consumption Device (CD)

- Counterparty.counterpartyId

- Counterparty.counterpartyName

- Counterparty.isBeneficiary

- Cross-Device Authorization

- Customer

- Customer.Credit.rating

- Customer.Credit.source

- Customer.attributeAlias

- Customer.attributeId

- Customer.attributeId

- Customer.attributeName

- Customer.attributeType

- Customer.attributeValue

- Customer.consumerId

- Customer.customerAccountLinkId

- Customer.customerAttributeId

- Customer.customerAttributeName

- Customer.customerAttributeType

- Customer.customerAttributeValue

- Customer.customerId

- Customer.customerNumber

- Customer.customer_id

- Customer.dependants

- Customer.dependents

- Customer.employmentStatus

- Customer.highestEducationAttained

- Customer.key

- Customer.kycStatus

- Customer.legalName

- Customer.mobileNumber

- Customer.nameSuffix

- Customer.relationshipStatus

- Customer.relationshipType

- Customer.secret

- Customer.title

- Customer.url

- DAuth

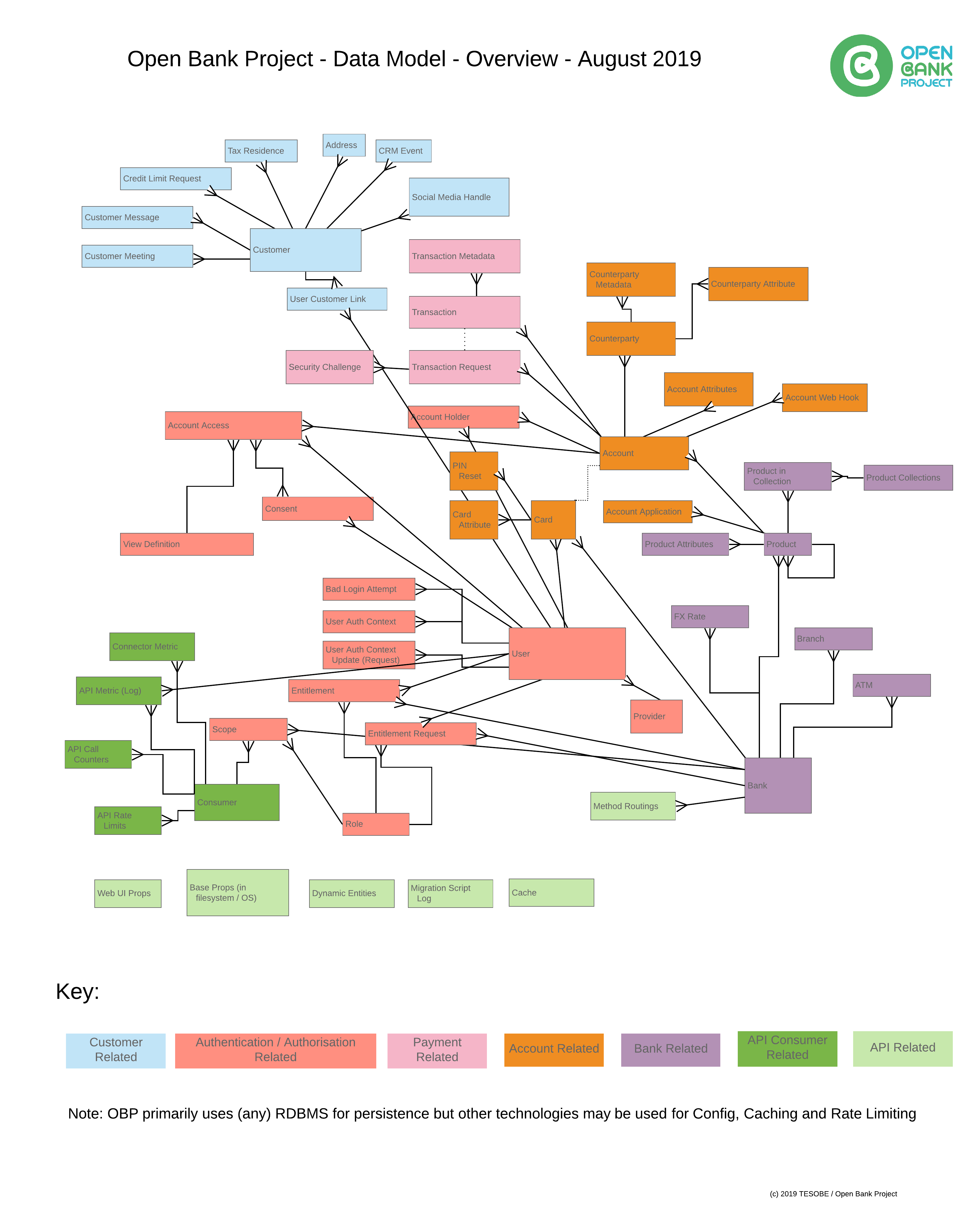

- Data Model Overview

- Direct Login

- Dummy Customer Logins

- Dynamic Endpoint Manage

- Dynamic Entity Manage

- Dynamic Message Doc

- Dynamic linking (PSD2 context)

- DynamicConnectorMethod.lang

- DynamicConnectorMethod.methodBody.Java

- DynamicConnectorMethod.methodBody.Js

- DynamicConnectorMethod.methodBody.scala

- DynamicMessageDoc.dynamicMessageDocId

- DynamicMessageDoc.inboundAvroSchema

- DynamicMessageDoc.outboundAvroSchema

- DynamicResourceDoc.description

- DynamicResourceDoc.dynamicResourceDocId

- DynamicResourceDoc.errorResponseBodies

- DynamicResourceDoc.exampleRequestBody

- DynamicResourceDoc.implementedInApiVersion

- DynamicResourceDoc.isFeatured

- DynamicResourceDoc.methodBody

- DynamicResourceDoc.partialFunction

- DynamicResourceDoc.partialFunctionName

- DynamicResourceDoc.partialFunctionName

- DynamicResourceDoc.requestUrl

- DynamicResourceDoc.requestVerb

- DynamicResourceDoc.specialInstructions

- DynamicResourceDoc.specifiedUrl

- DynamicResourceDoc.successResponseBody

- DynamicResourceDoc.summary

- Echo Request Headers

- Endpoint

- Endpoint Mapping

- EndpointTag.endpointTagId

- EndpointTag.tagName

- FAPI

- FAPI 1.0

- FAPI 2.0

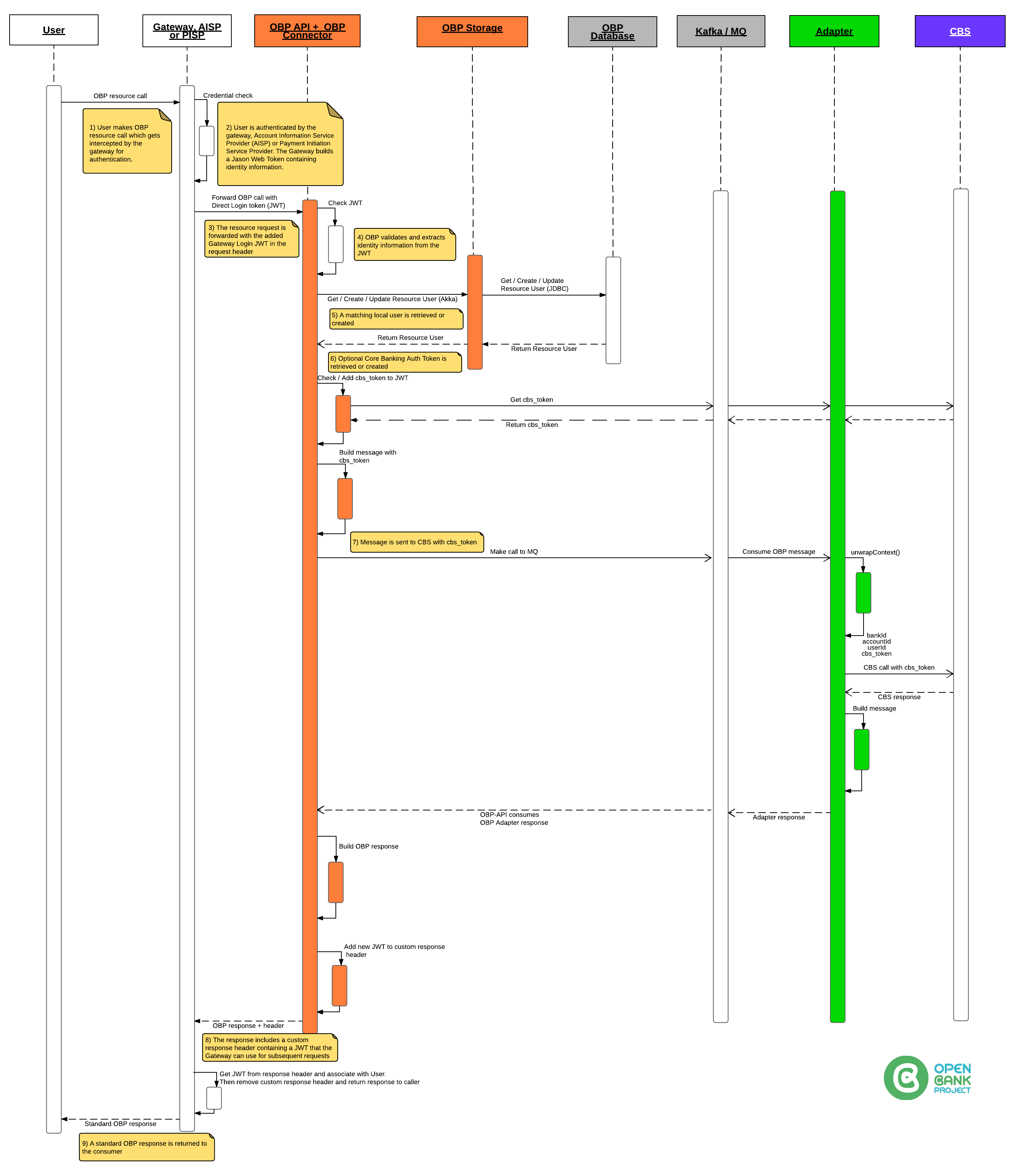

- Gateway Login

- Hola App log trace

- How OpenID Connect Works

- JSON Schema Validation

- Just In Time Entitlements

- KYC (Know Your Customer)

- License.id

- License.name

- Message Doc

- Method Routing

- Multi-factor authentication (MFA)

- OAuth 1.0a

- OAuth 2

- OAuth 2.0

- OCSP

- OIDC

- OpenID Connect with Google

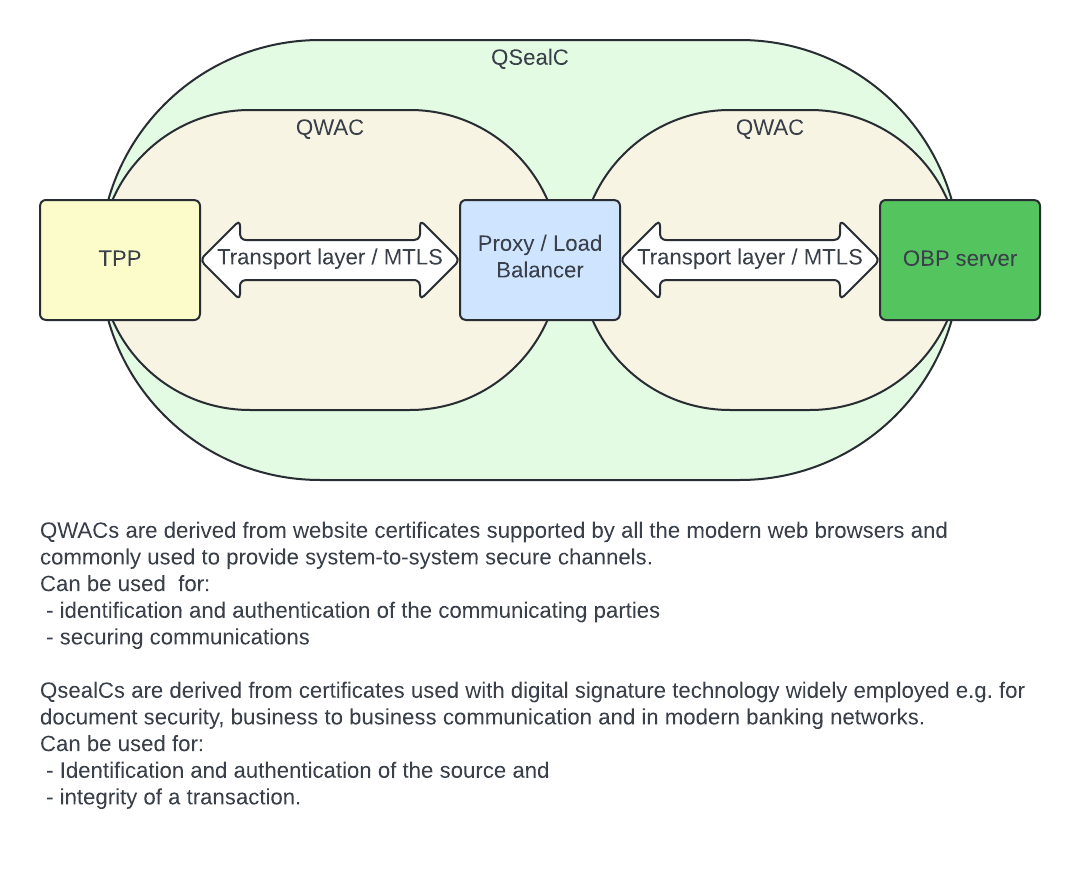

- QSealC

- QWAC

- Qualified Certificate Profiles (PSD2 context)

- Risk-based authentication

- SCA (Strong Customer Authentication)

- Sandbox Introduction

- Scenario 1: Onboarding a User

- Scenario 2: Create a Public Account

- Scenario 3: Create counterparty and make payment

- Scenario 4: Grant account access to another User

- Scenario 5: Onboarding a User using Auth Context

- Scenario 6: Update credit score based on transaction and device data.

- Scenario 7: Onboarding a User with multiple User Auth Context records

- Space

- Static Endpoint

- TPP

- Template.attributeName

- Template.attributeType

- Transaction

- Transaction Requests

- Transaction Requests.Transaction Request Refund Reason Code

- Transaction Requests.Transaction Request Type

- Transaction Requests.attributeId

- Transaction Requests.attributeName

- Transaction Requests.attributeType

- Transaction Requests.attributeValue

- Transaction Requests.id

- Transaction request challenge threshold

- Transaction.attributeId

- Transaction.attributeName

- Transaction.attributeType

- Transaction.attributeValue

- Transaction.charge_policy

- Transaction.otherAccountProvider

- Transaction.transactionDescription

- Transaction.transactionId

- Transaction.transactionType

- User

- User Customer Links

- User.attributeName

- User.attributeType

- User.attributeValue

- User.isPersonal

- User.password

- User.provider

- User.provider_id

- User.userId

- User.userNameExample

- User.user_id

- User.username

- accessibility_features

- accessiblefeatures

- account

- account_application_id

- account_applications

- account_attribute_id

- account_attributes

- account_otp

- account_routing

- account_routings

- account_rules

- account_webhook_id

- accounts

- active

- actual_date

- adapter_implementation

- address

- addresses

- age

- akka

- alias

- allowed_actions

- allowed_attempts

- allows

- answer

- api_version

- app_name

- app_type

- atm_id

- atms

- attribute_definition_id

- attribute_id

- attributes

- auth_context_update_id

- available_funds_request_id

- average_response_time

- bad_attempts_since_last_success_or_reset

- balance

- bank

- bank_code

- bank_id_pattern

- bank_routing

- bank_routings

- bankid

- banks

- basket_id

- bespoke

- bic

- branch_number

- branch_routing

- branch_routings

- branch_type

- branches

- cache

- calls_made

- can_add_comment

- can_add_corporate_location

- can_add_counterparty

- can_add_image

- can_add_image_url

- can_add_more_info

- can_add_open_corporates_url

- can_add_physical_location

- can_add_private_alias

- can_add_public_alias

- can_add_tag

- can_add_transaction_request_to_any_account

- can_add_transaction_request_to_own_account

- can_add_url

- can_add_where_tag

- can_be_seen_on_views

- can_create_direct_debit

- can_create_standing_order

- can_delete_comment

- can_delete_corporate_location

- can_delete_image

- can_delete_physical_location

- can_delete_tag

- can_delete_where_tag

- can_edit_owner_comment

- can_query_available_funds

- can_see_bank_account_balance

- can_see_bank_account_bank_name

- can_see_bank_account_credit_limit

- can_see_bank_account_currency

- can_see_bank_account_iban

- can_see_bank_account_label

- can_see_bank_account_national_identifier

- can_see_bank_account_number

- can_see_bank_account_owners

- can_see_bank_account_routing_address

- can_see_bank_account_routing_scheme

- can_see_bank_account_swift_bic

- can_see_bank_account_type

- can_see_bank_routing_address

- can_see_bank_routing_scheme

- can_see_comments

- can_see_corporate_location

- can_see_image_url

- can_see_images

- can_see_more_info

- can_see_open_corporates_url

- can_see_other_account_bank_name

- can_see_other_account_iban

- can_see_other_account_kind

- can_see_other_account_metadata

- can_see_other_account_national_identifier

- can_see_other_account_number

- can_see_other_account_routing_address

- can_see_other_account_routing_scheme

- can_see_other_account_swift_bic

- can_see_other_bank_routing_address

- can_see_other_bank_routing_scheme

- can_see_owner_comment

- can_see_physical_location

- can_see_private_alias

- can_see_public_alias

- can_see_tags

- can_see_transaction_amount

- can_see_transaction_balance

- can_see_transaction_currency

- can_see_transaction_description

- can_see_transaction_finish_date

- can_see_transaction_metadata

- can_see_transaction_other_bank_account

- can_see_transaction_start_date

- can_see_transaction_this_bank_account

- can_see_transaction_type

- can_see_url

- can_see_where_tag

- cancelled

- card_attributes

- card_description

- cards

- category

- challenge

- challenge_type

- channel

- charge

- checks

- city

- client_id (Client ID)

- closing_time

- code

- collected

- collection_code

- comment_id

- comments

- company

- completed

- connector_name

- connector_version

- consent_id

- consent_request_id

- consents

- consumers

- contact_details

- conversion_value

- corporate_location

- count

- counterparties

- counterparty

- counterparty_limit_id

- country

- country_code

- county

- created

- created_by_user

- created_by_user_id

- creator

- credit_limit

- credit_rating

- creditoraccount

- creditorname

- crm_events

- current_credit_documentation

- current_state

- customer

- customer_address_id

- customer_attributes

- customer_name

- customer_token

- customer_user_id

- customers

- data.bankid

- date_activated

- date_added

- date_inserted

- date_of_application

- debtoraccount

- dependent_endpoints

- description

- detail

- details

- developer_email

- direct_debit_id

- display_name

- distribution_channel

- dob_of_dependants

- document_number

- documents

- domain

- drive_up

- driveup

- duration

- duration_time

- e

- effective_date

- elastic_search

- email_address

- enabled

- end_date

- energy_source

- entitlement_id

- entitlement_request_id

- entitlement_requests

- entitlements

- errorCode

- everything

- example_inbound_message

- example_outbound_message

- execution_date

- execution_time

- face_image

- family

- field

- first_check_number

- first_name

- free_form

- frequency

- friday

- from

- from_currency_code

- from_date

- from_department

- from_person

- full_name

- function_name

- future_date

- generate_accountants_view

- generate_auditors_view

- generate_public_view

- glossary_items

- group

- handle

- hide_metadata_if_alias_used

- holder

- holders

- hosted_at

- hosted_by

- hours

- how

- html

- http_method

- http_protocol

- id

- id

- image_id

- image_url

- images

- implemented_by_partial_function

- implemented_in_version

- inbound_topic

- inboundavroschema

- index

- instructedamount

- inverse_conversion_value

- invitees

- is_active

- is_alias

- is_bank_id_exact_match

- is_firehose

- is_public

- issue_place

- items

- jsonstring

- jwks_uri

- jwks_uris

- jwt

- keys

- kid

- kind

- kty

- kyc_check_id

- kyc_document

- kyc_document_id

- kyc_media_id

- last_failure_date

- last_lock_date

- last_name

- last_ok_date

- latitude

- license

- line1

- line2

- line3

- link

- list

- lobby

- location

- log_level

- logo

- longitude

- markdown

- match_all

- max_monthly_amount

- max_number_of_monthly_transactions

- max_number_of_yearly_transactions

- max_single_amount

- max_yearly_amount

- maximum_response_time

- medias

- meeting_id

- meetings

- member_product_code

- message

- message_docs

- message_format

- messages

- meta

- metadata

- metadata_view

- method_name

- method_routing_id

- method_routings

- metrics

- minimum_response_time

- mobile_phone

- mobile_phone_number

- monday

- more_info

- more_info_url

- n

- name

- narrative

- national_identifier

- networks

- new_balance

- nickname

- nominal_interest1

- nominal_interest2

- none

- number

- number_of_checkbooks

- ok

- on_hot_list

- open_corporates_url

- opening_time

- order

- order_date

- order_id

- orders

- organisation

- organisation_website

- other_account

- other_account_id

- other_account_routing_address

- other_account_routing_scheme

- other_account_secondary_routing_address

- other_account_secondary_routing_scheme

- other_accounts

- other_bank_routing_address

- other_bank_routing_scheme

- other_branch_routing_address

- other_branch_routing_scheme

- outbound_topic

- outboundavroschema

- overall_balance

- overall_balance_date

- owners

- parameters

- parent_product

- parent_product_code

- payload

- paymentService

- per_day

- per_day_call_limit

- per_hour

- per_hour_call_limit

- per_minute

- per_minute_call_limit

- per_month

- per_month_call_limit

- per_second

- per_second_call_limit

- per_week

- per_week_call_limit

- permissions

- phone

- phone_number

- physical_location

- pin_reset

- ports

- post_code

- postcode

- posted

- present

- private_alias

- process

- product_attribute_id

- product_attributes

- product_code

- product_collection

- product_fee_id

- product_name

- products

- property

- provider

- provider_id

- public_alias

- purpose

- purpose_id

- query

- rank_amount1

- rank_amount2

- reason_requested

- reasons

- redirect_url

- relates_to_kyc_check_id

- relates_to_kyc_document_id

- replacement

- request_id

- requested_current_rate_amount1

- requested_current_rate_amount2

- requested_current_valid_end_date

- requested_temporary_valid_end_date

- require_scopes_for_all_roles

- require_scopes_for_listed_roles

- requiredfieldinfo

- requires_bank_id

- reset_in_seconds

- reset_password_url

- result

- revoked

- role

- role_name

- roles

- sandbox_tan

- satisfied

- saturday

- sca_method

- scheduled_date

- scheme

- scope_id

- scopes

- sepa

- sepaB2b

- sepaCardClearing

- sepaCreditTransfer

- sepaDirectDebit

- sepaSddCore

- service_available

- settlement_accounts

- shipping_code

- short_code

- short_name

- short_reference

- shortcode

- sms

- staff_name

- staff_token

- staff_user_id

- standing_order_id

- state

- status

- statuses

- success

- suggested_order

- summary

- sunday

- super_family

- supported_currencies

- supported_languages

- swift_bic

- tag_id

- tags

- tax_number

- tax_residence

- tax_residence_id

- technology

- temporary_credit_documentation

- temporary_requested_current_amount

- terms_and_conditions_url_example

- text

- this_account

- this_account_id

- this_bank_id

- this_view_id

- thursday

- time_to_live

- to

- to_counterparty

- to_currency_code

- to_date

- to_sandbox_tan

- to_sepa

- to_sepa_credit_transfers

- to_transfer_to_account

- to_transfer_to_atm

- to_transfer_to_phone

- token

- top_apis

- top_consumers

- transaction_attributes

- transaction_ids

- transaction_request_types

- transaction_requests_with_charges

- transaction_types

- transactions

- transfer_type

- transport

- trigger_name

- ttl_in_seconds

- tuesday

- type

- type_of_lock

- use

- use_type

- user

- user_auth_context_id

- user_auth_context_update_id

- user_auth_contexts

- user_customer_link_id

- user_customer_links

- users

- valid_from

- verb

- version

- version_status

- view

- view.description

- view.id

- view.is_system

- view.name

- views

- views_available

- views_basic

- vrp_consent_request.payload

- warehouse

- web_hooks

- web_ui_props_id

- website

- webui_props

- wednesday

- when

- where

- which_alias_to_use

API Glossary

API

The terms API (Application Programming Interface) and Endpoint are used somewhat interchangeably.

However, an API normally refers to a group of Endpoints.

An endpoint has a unique URL path and HTTP verb (GET, POST, PUT, DELETE etc).

When we POST a Swagger file to the Create Endpoint endpoint, we are in fact creating a set of Endpoints that have a common Tag. Tags are used to group Endpoints in the API Explorer and filter the Endpoints in the Resource Doc endpoints.

Endpoints can also be grouped together in Collections.

See also Endpoint

API Collection

An API Collection is a collection of endpoints grouped together for a certain purpose.

Having read access to a Collection does not constitute execute access on the endpoints in the Collection.

(Execute access is governed by Entitlements to Roles - and in some cases, Views.)

Collections can be created and shared. You can make a collection non-sharable but the default is sharable.

Your "Favourites" in API Explorer is actually a collection you control named "Favourites".

To share a Collection (e.g. your Favourites) just click on your Favourites in the API Explorer and share the URL in the browser. If you want to share the Collection via an API, just share the collection_id with a developer.

If you share a Collection it can't be modified by anyone else, but anyone can use it as a basis for their own Favourites or another collection.

There are over 13 endpoints for controlling Collections.

Some of these endpoints require Entitlements to Roles and some operate on your own personal collections such as your favourites.

API.Access Control

Access Control is achieved via the following mechanisms in OBP:

-

APIs are enabled in Props. See the README.md

-

Consumers (Apps) are granted access to Roles and Views via Scopes (WIP)

See here for related endpoints and documentation.

- Users are granted access to System or Bank Roles via Entitlements.

See here for related endpoints and documentation.

Users may request Entitlement Requests here

Entitlements and Entitlement Requests can be managed in the OBP API Manager.

- Users are granted access to Customer Accounts, Transactions and Payments via Views.

See here for related endpoints and documentation.

User Views can be managed via the OBP Sofit Consent App.

API.correlation_id

Example value: 1flssoftxq0cr1nssr68u0mioj

Description: A string generated by OBP-API that MUST uniquely identify the API call received by OBP-API. Used for debugging and logging purposes. It is returned in header to the caller.

ATM.attribute_id

Example value: atme-9a0f-4bfa-b30b-9003aa467f51

Description: A string that MUST uniquely identify the ATM on this OBP instance.

Account

The thing that tokens of value (money) come in and out of.

An account has one or more owners which are Users.

In the future, Customers may also be owners.

An account has a balance in a specified currency and zero or more transactions which are records of successful movements of money.

Account Access

Account Access governs access to Bank Accounts by end Users. It is an intersecting entity between the User and the View Definition.

A User must have at least one Account Access record record in order to interact with a Bank Account over the OBP API.

Account.account_id

An identifier for the account that MUST NOT leak the account number or other identifier nomrally used by the customer or bank staff.

It SHOULD be a UUID. It MUST be unique in combination with the BANK_ID. ACCOUNT_ID is used in many URLS so it should be considered public.

(We do NOT use account number in URLs since URLs are cached and logged all over the internet.)

In local / sandbox mode, ACCOUNT_ID is generated as a UUID and stored in the database.

In non sandbox modes (Kafka etc.), ACCOUNT_ID is mapped to core banking account numbers / identifiers at the South Side Adapter level.

ACCOUNT_ID is used to link Metadata and Views so it must be persistant and known to the North Side (OBP-API).

Example value: 8ca8a7e4-6d02-40e3-a129-0b2bf89de9f0

Account.account_routing_address

Example value: DE91 1000 0000 0123 4567 89

Description: An identifier that conforms to account_routing_scheme / accountRoutingScheme

Account.account_routing_scheme

Example value: IBAN

Description: The scheme that the account_routing_address / accountRoutingAddress is an example of.

Account.iban

Example value: DE91 1000 0000 0123 4567 89

Description: MUST uniquely identify the bank account globally.

Account.queryTagsExample

Example value: Card,Debit

Description: This field is only used for OBP to distinguish the debit accounts, card accounts ...

Adapter.Akka.Intro

Use Akka as an interface between OBP and your Core Banking System (CBS).

For an introduction to Akka see here

The OBP Akka interface allows integrators to write Java or Scala Adapters (any JVM language with Akka support)

respond to requests for data and services from OBP.

For the message definitions see here

Installation Prerequisites

-

You have OBP-API running.

-

Ideally you have API Explorer running (the application serving this page) but its not necessary - you could use any other REST client.

- You might want to also run API Manager as it makes it easier to grant yourself roles, but its not necessary - you could use the API Explorer / any REST client instead.

Create a Customer User and an Admin User

- Register a User who will use the API as a Customer.

- Register another User that will use the API as an Admin. The Admin user will need some Roles. See here. You can bootstrap an Admin user by editing the Props file. See the README for that.

Add some authentication context to the Customer User

- As the Admin User, use the Create Auth Context endpoint to add one or more attributes to the Customer User.

For instance you could add the name/value pair CUSTOMER_NUMBER/889763 and this will be sent to the Adapter / CBS inside the AuthInfo object.

Now you should be able to use the Get Auth Contexts endpoint to see the data you added.

Write or Build an Adapter to respond to the following messages.

When getting started, we suggest that you implement the messages in the following order:

1) Core (Prerequisites) - Get Adapter, Get Banks, Get Bank

Now you should be able to use the Adapter Info endpoint

Now you should be able to use the Get Banks endpoint

Now you should be able to use the Get Bank endpoint

2) Get Customers by USER_ID

Now you should be able to use the Get Customers endpoint.

3) Get Accounts

The above messages should enable at least the following endpoints:

4) Get Account

The above message should enable at least the following endpoints:

5) Get Transactions

6) Manage Counterparties

7) Get Transaction Request Types

- This is configured using OBP Props - No messages required

This glossary item is Work In Progress.

Adapter.Kafka.Intro

Use Kafka as an interface between OBP and your Core Banking System (CBS).

For an introduction to Kafka see here

Installation Prerequisites

-

You have OBP-API running and it is connected to a Kafka installation.

You can check OBP -> Kafka connectivity using the "loopback" endpoint. -

Ideally you have API Explorer running (the application serving this page) but its not necessary - you could use any other REST client.

- You might want to also run API Manager as it makes it easier to grant yourself roles, but its not necessary - you could use the API Explorer / any REST client instead.

Create a Customer User and an Admin User

- Register a User who will use the API as a Customer.

- Register another User that will use the API as an Admin. The Admin user will need some Roles. See here. You can bootstrap an Admin user by editing the Props file. See the README for that.

Add some authentication context to the Customer User

- As the Admin User, use the Create Auth Context endpoint to add one or more attributes to the Customer User.

For instance you could add the name/value pair CUSTOMER_NUMBER/889763 and this will be sent to the Adapter / CBS inside the AuthInfo object.

Now you should be able to use the Get Auth Contexts endpoint to see the data you added.

Write or Build an Adapter to respond to the following messages.

When getting started, we suggest that you implement the messages in the following order:

1) Core (Prerequisites) - Get Adapter, Get Banks, Get Bank

Now you should be able to use the Adapter Info endpoint

Now you should be able to use the Get Banks endpoint

Now you should be able to use the Get Bank endpoint

2) Core (Authentications) -The step1 Apis are all anonymous access. If you need to link bank customer data to the obp user,

Then you need link OBP user with Bank user/customer using the Create User Auth Context. Also

check the description for this endpoint. Once you create the user-auth-context for one user, then these user-auth-context key value pair

can be propagated over connector message. Than the Adapter can use it to map OBP user and Bank user/customer.

Now you should be able to use the Refresh User endpoint

3) Customers for logged in User

Now you should be able to use the Get Customers endpoint.

4) Get Accounts

Now you should already be able to use the Get Accounts at Bank (IDs only). endpoint.

The above messages should enable at least the following endpoints:

5) Get Account

The above message should enable at least the following endpoints:

6) Get Transactions

7) Manage Counterparties

8) Get Transaction Request Types

- This is configured using OBP Props - No messages required

9) Get Challenge Threshold (CBS)

10) Make Payment (used by Create Transaction Request)

- obp.makePaymentv210

- This also requires 8,9,10 for high value payments.

11) Get Transaction Requests.

12) Generate Security Challenges (CBS)

13) Answer Security Challenges (Validate)

- Optional / Internal OBP (No additional messages required)

14) Manage Counterparty Metadata

- Internal OBP (No additional messages required)

15) Get Entitlements

- Internal OBP (No additional messages required)

16) Manage Roles

- Internal OBP (No additional messages required)

17) Manage Entitlements

- Internal OBP (No additional messages required)

18) Manage Views

- Internal OBP (No additional messages required)

19) Manage Transaction Metadata

- Internal OBP (No additional messages required)

Adapter.Stored_Procedure.Intro

Use Stored_Procedure as an interface between OBP and your Core Banking System (CBS).

For an introduction to Stored Procedures see here

Installation Prerequisites

- You have OBP-API running and it is connected to a stored procedure related database.

- Ideally you have API Explorer running (the application serving this page) but its not necessary - you could use any other REST client.

- You might want to also run API Manager as it makes it easier to grant yourself roles, but its not necessary - you could use the API Explorer / any REST client instead.

Adapter.authInfo

authInfo is a JSON object sent by the Connector to the Adapter so the Adapter and/or Core Banking System can

identify the User making the call.

The authInfo object contains several optional objects and fields.

Please see the Message Docs for your connector for the current JSON structure. The following serves as a guide:

- userId is the user_id as generated by OBP

- username can be chosen explicitly to match an existing customer number (not recommended)

- linkedCustomers is a list of Customers the User is explicitly linked to. Use the Create User Customer Link endpoint to populate this data.

- userAuthContexts may contain the customer number or other tokens in order to boot strap the User Customer Links

or provide an alternative method of tagging the User with an authorisation context.

Use the Create UserAuthContext endpoint to populate this data. - cbsToken is a token used by the CBS to identify the user's session. Either generated by the CBS or Gateway.

- isFirst is a flag that indicates that OBP should refresh the user's list of accounts from the CBS (and flush / invalidate any User's cache)

- correlationId just identifies the API call.

- authViews are entitlements given by account holders to third party users e.g. Sam may grant her accountant Jill read only access to her business account. See the Create View endpoint

Adapter.card_attribute_id

Example value: b4e0352a-9a0f-4bfa-b30b-9003aa467f50

Description: A string that MUST uniquely identify the card attribute on this OBP instance. It SHOULD be a UUID.

Adapter.card_attribute_name

Example value: OVERDRAFT_START_DATE

Description: The Card attribute name

Adapter.card_id

Example value: 36f8a9e6-c2b1-407a-8bd0-421b7119307e

Description: A string that MUST uniquely identify the card on this OBP instance. It SHOULD be a UUID.

Adapter.card_type

Example value: Credit

Description: The type of the physical card. eg: credit, debit ...

Adapter.cbsToken

Example value: FYIUYF6SUYFSD

Description: A token provided by the Gateway for use by the Core Banking System

Adapter.issue_number

Example value: 1

Description: The issue number of the physical card, eg 1,2,3,4 ....

Adapter.key

Example value: CustomerNumber

Description: This key should be used with Adapter.value together. They are a pair.

Adapter.provider_id

Example value: Chris

Description: The provider id of the user which is equivalent to the username.

Adapter.serial_number

Example value: 1324234

Description: The serial number of the physical card, eg 1123.

Adapter.value

Example value: 5987953

Description: This key should be used with Adapter.key together. They are a pair.

Adaptive authentication

Adaptive authentication, also known as risk-based authentication, is dynamic in a way it automatically triggers additional authentication factors, usually via MFA factors, depending on a user's risk profile.

An example of this authentication at OBP-API side is the feature "Transaction request challenge threshold".

-

ApiCollection.apiCollectionId

Example value: 7uy8a7e4-6d02-40e3-a129-0b2bf89de8uh

Description: A string that MUST uniquely identify the session on this OBP instance, can be used in all cache.

ApiCollectionEndpoint.apiCollectionEndpointId

Example value: 8uy8a7e4-6d02-40e3-a129-0b2bf89de8uh

Description: A string that MUST uniquely identify the session on this OBP instance, can be used in all cache.

ApiCollectionEndpoint.operationId

Example value: OBPv4.0.0-getBanks

Description: A uniquely identify the obp endpoint on OBP instance, you can get it from Get Resource endpoints.

Authentication Device (AD)

The device on which the user will authenticate and authorize the request, often a smartphone.

Authentication.provider

Example value: http://127.0.0.1:8080

Description: The Provider authenticating this User

Available FAPI profiles

The following are the FAPI profiles which are either in use by multiple implementers or which are being actively developed by the OpenID Foundation’s FAPI working group:

Bank

A Bank (aka Space) represents a financial institution, brand or organizational unit under which resources such as endpoints and entities exist.

Both standard entities (e.g. financial products and bank accounts in the OBP standard) and dynamic entities and endpoints (created by you or your organisation) can exist at the Bank level.

For example see Bank/Space level Dynamic Entities and Bank/Space level Dynamic Endpoints

The Bank is important because many Roles can be granted at the Bank level. In this way, it's possible to create segregated or partitioned sets of endpoints and data structures in a single OBP instance.

A User creating a Bank (if they have the right so to do), automatically gets the Entitlement to grant any Role for that Bank. Thus the creator of a Bank / Space becomes the "god" of that Bank / Space.

Basic attributes for the bank resource include identifying information such as name, logo and website.

Using the OBP endpoints for bank accounts it's possible to view accounts at one Bank or aggregate accounts from all Banks connected to the OBP instance.

See also Props settings named "brand".

Bank.bank_id

An identifier that uniquely identifies the bank or financial institution on the OBP-API instance.

It is typically a human (developer) friendly string for ease of identification.

It SHOULD NOT contain spaces.

In sandbox mode it typically has the form: "financialinstitutuion.sequencennumber.region.language". e.g. "bnpp-irb.01.it.it"

For production, it's value could be the BIC of the institution.

Example value: gh.29.uk

Bank.bank_id

Example value: gh.29.uk

Description: A string that MUST uniquely identify the bank on this OBP instance. It COULD be a UUID but is generally a short string that easily identifies the bank / brand it represents.

Bank.bank_routing_address

Example value: GENODEM1GLS

Description: An identifier that conforms to bank_routing_scheme / bankRoutingScheme

Bank.bank_routing_scheme

Example value: BIC

Description: The scheme that the bank_routing_address / bankRoutingAddress is an example of.

Branch.branch_id

Example value: DERBY6

Description: Uniquely identifies the Branch in combination with the bankId.

Branch.branch_routing_address

Example value: DERBY6

Description: An address that conforms to branch_routing_scheme / branchRoutingScheme

Branch.branch_routing_scheme

Example value: BRANCH-CODE

Description: The scheme that the branch_routing_address / branchRoutingAddress is an example of.

CIBA

An acronym for Client-Initiated Backchannel Authentication.

For more details about it please take a look at the official specification: OpenID Connect Client Initiated Backchannel Authentication Flow

Please note it is a cross-device protocol and SHOULD not be used for same-device scenarios.

If the Consumption Device and Authorization Device are the same device, protocols like OpenID Connect Core OpenID.Core and OAuth 2.0 Authorization Code Grant as defined in RFC6749 are more appropriate.

CRL

Certificate Revocation List.

CRL issuers issue CRLs. The CRL issuer is either the CA (certification authority) or an entity that has been authorized by the CA to issue CRLs.

CAs publish CRLs to provide status information about the certificates they issued.

However, a CA may delegate this responsibility to another trusted authority.

It is described in RFC 5280.

ChallengeAnswer.challengeId

Example value: 123chaneid13-6d02-40e3-a129-0b2bf89de9f0

Description: MUST uniquely identify the challenge globally.

ChallengeAnswer.hashOfSuppliedAnswer

Example value: a665a45920422f9d417e4867efdc4fb8a04a1f3fff1fa07e998e86f7f7a27ae3

Description: Sha256 hash value of the ChallengeAnswer.challengeId

ChallengeAnswer.suppliedAnswerExample

Example value: 123456

Description: The value of the ChallengeAnswer.challengeId

Connector

In OBP, most internal functions / methods can have different implementations which follow the same interface.

These functions are called connector methods and their implementations.

The default implementation of the connector is the "mapped" connector.

It's called "mapped" because the default datasource on OBP is a relational database, and access to that database is always done through an Object-Relational Mapper (ORM) called Mapper (from a framework we use called Liftweb).

[=============] [============] [============] [.............] [ ] [ ] [...OBP API...] ===> OBP Endpoints call connector functions (aka methods) ===> [ Connector ] ===> [ Database ] [.............] The default implementation is called "Mapped" [ (Mapped) ] [ (Adapter) ] [=============] The Mapped Connector talks to a Database [============] [============]

However, there are multiple available connector implementations - and you can also mix and create your own.|

E.g. Kafka

[=============] [============] [============] [============] [============] [ ] [ ] [ ] [ ] [ ] [ OBP API ] ===> Kafka Connector ===> [ Kafka ] ===> [ Kafka ] [ OBP Kafka ] ===> [ CBS ] [ ] Puts OBP Messages [ Connector ] [ Cluster ] [ Adapter ] [ ] [=============] onto a Kafka [============] [============] [============] [============]

You can mix and match them using the Star connector and you can write your own in Scala. You can also write Adapters in any language which respond to messages sent by the connector.

we use the term "Connector" to mean the Scala/Java/Other JVM code in OBP that connects directly or indirectly to the systems of record i.e. the Core Banking Systems, Payment Systems and Databases.

A "Direct Connector" is considered to be one that talks directly to the system of record or existing service layer.

i.e. API -> Connector -> CBS

An "Indirect Connector" is considered one which pairs with an Adapter which in turn talks to the system of record or service layer.

i.e. API -> Connector -> Adapter -> CBS

The advantage of a Direct connector is that its perhaps simpler. The disadvantage is that you have to code in a JVM language, understand a bit about OBP internals and a bit of Scala.

The advantage of the Indirect Connector is that you can write the Adapter in any language and the Connector and Adapter are decoupled (you just have to respect the Outbound / Inbound message format).

The default Connector in OBP is a Direct Connector called "mapped". It is called the "mapped" connector because it talks directly to the OBP database (Postgres, MySQL, Oracle, MSSQL etc.) via the Liftweb ORM which is called Mapper.

If you want to create your own (Direct) Connector you can fork any of the connectors within OBP.

There is a special Connector called the Star Connector which can use functions from all the normal connectors.

Using the Star Connector we can dynamically reroute function calls to different Connectors per function per bank_id.

The OBP API Manager has a GUI to manage this or you can use the OBP Method Routing APIs to set destinations for each function call.

Note: We generate the source code for individual connectors automatically.

Connector Method

Developers can override all the existing Connector methods.

This function needs to be used together with the Method Routing.

When we set "connector = internal", then the developer can call their own method body at API level.

For example, the GetBanks endpoint calls the connector "getBanks" method. Then, developers can use these endpoints to modify the business logic in the getBanks method body.

The following videos are available:

* Introduction for Connector Method

* Introduction 2 for Connector Method

ConnectorMethod.connectorMethodId

Example value: ace0352a-9a0f-4bfa-b30b-9003aa467f51

Description: A string that MUST uniquely identify the connector method on this OBP instance, can be used in all cache.

Consent

Consents provide a mechanism by which a third party App or User can access resources on behalf of a User.

Consent OBP Flow Example

1) Call endpoint Create Consent Request using application access (Client Credentials)

Url: https://apisandbox.openbankproject.com/obp/v5.0.0/consumer/consent-requests

Post body:

{

"everything": false,

"account_access": [],

"entitlements": [

{

"bank_id": "gh.29.uk.x",

"role_name": "CanGetCustomer"

}

],

"email": "marko@tesobe.com"

}

Output:

{

"consent_request_id":"bc0209bd-bdbe-4329-b953-d92d17d733f4",

"payload":{

"everything":false,

"account_access":[],

"entitlements":[{

"bank_id":"gh.29.uk.x",

"role_name":"CanGetCustomer"

}],

"email":"marko@tesobe.com"

},

"consumer_id":"0b34068b-cb22-489a-b1ee-9f49347b3346"

}

2) Call endpoint Create Consent By CONSENT_REQUEST_ID (SMS) with logged on user

Output:

{

"consent_id":"155f86b2-247f-4702-a7b2-671f2c3303b6",

"jwt":"eyJhbGciOiJIUzI1NiJ9.eyJlbnRpdGxlbWVudHMiOlt7InJvbGVfbmFtZSI6IkNhbkdldEN1c3RvbWVyIiwiYmFua19pZCI6ImdoLjI5LnVrLngifV0sImNyZWF0ZWRCeVVzZXJJZCI6ImFiNjUzOWE5LWIxMDUtNDQ4OS1hODgzLTBhZDhkNmM2MTY1NyIsInN1YiI6IjU3NGY4OGU5LTE5NDktNDQwNy05NTMwLTA0MzM3MTU5YzU2NiIsImF1ZCI6IjFhMTA0NjNiLTc4NTYtNDU4ZC1hZGI2LTViNTk1OGY1NmIxZiIsIm5iZiI6MTY2OTg5NDU5OSwiaXNzIjoiaHR0cDpcL1wvMTI3LjAuMC4xOjgwODAiLCJleHAiOjE2Njk4OTgxOTksImlhdCI6MTY2OTg5NDU5OSwianRpIjoiMTU1Zjg2YjItMjQ3Zi00NzAyLWE3YjItNjcxZjJjMzMwM2I2Iiwidmlld3MiOltdfQ.lLbn9BtgKvgAcb07if12SaEyPAKgXOEmr6x3Y5pU-vE",

"status":"INITIATED",

"consent_request_id":"bc0209bd-bdbe-4329-b953-d92d17d733f4"

}

3) We receive the SCA message via SMS

Your consent challenge : 29131491, Application: Any application

4) Call endpoint Answer Consent Challenge with logged on user

Url: https://apisandbox.openbankproject.com/obp/v5.0.0/banks/gh.29.uk.x/consents/155f86b2-247f-4702-a7b2-671f2c3303b6/challenge

Post body:

{

"answer": "29131491"

}

Output:

{

"consent_id":"155f86b2-247f-4702-a7b2-671f2c3303b6",

"jwt":"eyJhbGciOiJIUzI1NiJ9.eyJlbnRpdGxlbWVudHMiOlt7InJvbGVfbmFtZSI6IkNhbkdldEN1c3RvbWVyIiwiYmFua19pZCI6ImdoLjI5LnVrLngifV0sImNyZWF0ZWRCeVVzZXJJZCI6ImFiNjUzOWE5LWIxMDUtNDQ4OS1hODgzLTBhZDhkNmM2MTY1NyIsInN1YiI6IjU3NGY4OGU5LTE5NDktNDQwNy05NTMwLTA0MzM3MTU5YzU2NiIsImF1ZCI6IjFhMTA0NjNiLTc4NTYtNDU4ZC1hZGI2LTViNTk1OGY1NmIxZiIsIm5iZiI6MTY2OTg5NDU5OSwiaXNzIjoiaHR0cDpcL1wvMTI3LjAuMC4xOjgwODAiLCJleHAiOjE2Njk4OTgxOTksImlhdCI6MTY2OTg5NDU5OSwianRpIjoiMTU1Zjg2YjItMjQ3Zi00NzAyLWE3YjItNjcxZjJjMzMwM2I2Iiwidmlld3MiOltdfQ.lLbn9BtgKvgAcb07if12SaEyPAKgXOEmr6x3Y5pU-vE",

"status":"ACCEPTED"

}

5) Call endpoint Get Customer by CUSTOMER_ID with Consent Header

Request Header:

Consent-JWT:eyJhbGciOiJIUzI1NiJ9.eyJlbnRpdGxlbWVudHMiOlt7InJvbGVfbmFtZSI6IkNhbkdldEN1c3RvbWVyIiwiYmFua19pZCI6ImdoLjI5LnVrLngifV0sImNyZWF0ZWRCeVVzZXJJZCI6ImFiNjUzOWE5LWIxMDUtNDQ4OS1hODgzLTBhZDhkNmM2MTY1NyIsInN1YiI6IjU3NGY4OGU5LTE5NDktNDQwNy05NTMwLTA0MzM3MTU5YzU2NiIsImF1ZCI6IjFhMTA0NjNiLTc4NTYtNDU4ZC1hZGI2LTViNTk1OGY1NmIxZiIsIm5iZiI6MTY2OTg5NDU5OSwiaXNzIjoiaHR0cDpcL1wvMTI3LjAuMC4xOjgwODAiLCJleHAiOjE2Njk4OTgxOTksImlhdCI6MTY2OTg5NDU5OSwianRpIjoiMTU1Zjg2YjItMjQ3Zi00NzAyLWE3YjItNjcxZjJjMzMwM2I2Iiwidmlld3MiOltdfQ.lLbn9BtgKvgAcb07if12SaEyPAKgXOEmr6x3Y5pU-

Output:

{

"bank_id":"gh.29.uk.x",

"customer_id":"a9c8bea0-4f03-4762-8f27-4b463bb50a93",

"customer_number":"0908977830011-#2",

"legal_name":"NONE",

"mobile_phone_number":"+3816319549071",

"email":"marko@tesobe.com1",

"face_image":{

"url":"www.openbankproject",

"date":"2017-09-18T22:00:00Z"

},

"date_of_birth":"2017-09-18T22:00:00Z",

"relationship_status":"Single",

"dependants":5,

"dob_of_dependants":[],

"credit_rating":{

"rating":"3",

"source":"OBP"

},

"credit_limit":{

"currency":"EUR",

"amount":"10001"

},

"highest_education_attained":"Bachelor’s Degree",

"employment_status":"Employed",

"kyc_status":true,

"last_ok_date":"2017-09-18T22:00:00Z",

"title":null,

"branch_id":"3210",

"name_suffix":null,

"customer_attributes":[]

}

Consent / Account Onboarding

Consent, or Account onboarding, is the process by which the account owner gives permission for their account(s) to be accessible to the API endpoints.

In OBP, the account, transaction and payment APIs are all guarded by Account Views - with one exception, the account holders endpoint which can be used to

bootstrap account on-boarding.

Note: the account holders endpoint is generally made available only to the Account Onboarding App, so if a View does not exist, no API access to the account is possible.

Consent or Account onboarding can be managed in one of two ways:

1) A backend system (CBS or other) is the system of record for User Consent, and OBP mirrors this.

In this case:

a) OBP requires the CBS or other backend system to return a list of accounts and permissions associated with a User.

b) At User login, OBP automatically creates one or more Views for that User based on the permissions supplied by the CBS.

2) OBP is the system of record for User Consent.

In this case:

a) OBP requires the CBS, Gateway or other system to provide just a basic list of accounts owned by the User.

b) The Onboarding App or Bank's Onboarding Page then authenticates the User and calls the Create View endpoint.

c) The account, transaction and payment API endpoints then work as moderated by the relevant View permissions.

d) The User can revoke access by calling the delete View endpoint.

In summary:

Prior to Views being created on an Account for a User, only the 'accounts held' endpoint will work for the account holder, and this endpoint only provides enough information

to identify the account so it can be selected and on-boarded into the API.

Once a View exists for an Account, a User can interact with the Account via the API based on permissions defined in the View.

Consent / Account Onboarding

Consent, or Account onboarding, is the process by which the account owner gives permission for their account(s) to be accessible to the API endpoints.

In OBP, the account, transaction and payment APIs are all guarded by Account Views - with one exception, the account holders endpoint which can be used to

bootstrap account on-boarding.

Note: the account holders endpoint is generally made available only to the Account Onboarding App, so if a View does not exist, no API access to the account is possible.

Consent or Account onboarding can be managed in one of two ways:

1) A backend system (CBS or other) is the system of record for User Consent, and OBP mirrors this.

In this case:

a) OBP requires the CBS or other backend system to return a list of accounts and permissions associated with a User.

b) At User login, OBP automatically creates one or more Views for that User based on the permissions supplied by the CBS.

2) OBP is the system of record for User Consent.

In this case:

a) OBP requires the CBS, Gateway or other system to provide just a basic list of accounts owned by the User.

b) The Onboarding App or Bank's Onboarding Page then authenticates the User and calls the Create View endpoint.

c) The account, transaction and payment API endpoints then work as moderated by the relevant View permissions.

d) The User can revoke access by calling the delete View endpoint.

In summary:

Prior to Views being created on an Account for a User, only the 'accounts held' endpoint will work for the account holder, and this endpoint only provides enough information

to identify the account so it can be selected and on-boarded into the API.

Once a View exists for an Account, a User can interact with the Account via the API based on permissions defined in the View.

Consent OBP Flow Example

1) Call endpoint Create Consent Request using application access (Client Credentials)

Url: https://apisandbox.openbankproject.com/obp/v5.0.0/consumer/consent-requests

Post body:

{

"everything": false,

"account_access": [],

"entitlements": [

{

"bank_id": "gh.29.uk.x",

"role_name": "CanGetCustomer"

}

],

"email": "marko@tesobe.com"

}

Output:

{

"consent_request_id":"bc0209bd-bdbe-4329-b953-d92d17d733f4",

"payload":{

"everything":false,

"account_access":[],

"entitlements":[{

"bank_id":"gh.29.uk.x",

"role_name":"CanGetCustomer"

}],

"email":"marko@tesobe.com"

},

"consumer_id":"0b34068b-cb22-489a-b1ee-9f49347b3346"

}

2) Call endpoint Create Consent By CONSENT_REQUEST_ID (SMS) with logged on user

Output:

{

"consent_id":"155f86b2-247f-4702-a7b2-671f2c3303b6",

"jwt":"eyJhbGciOiJIUzI1NiJ9.eyJlbnRpdGxlbWVudHMiOlt7InJvbGVfbmFtZSI6IkNhbkdldEN1c3RvbWVyIiwiYmFua19pZCI6ImdoLjI5LnVrLngifV0sImNyZWF0ZWRCeVVzZXJJZCI6ImFiNjUzOWE5LWIxMDUtNDQ4OS1hODgzLTBhZDhkNmM2MTY1NyIsInN1YiI6IjU3NGY4OGU5LTE5NDktNDQwNy05NTMwLTA0MzM3MTU5YzU2NiIsImF1ZCI6IjFhMTA0NjNiLTc4NTYtNDU4ZC1hZGI2LTViNTk1OGY1NmIxZiIsIm5iZiI6MTY2OTg5NDU5OSwiaXNzIjoiaHR0cDpcL1wvMTI3LjAuMC4xOjgwODAiLCJleHAiOjE2Njk4OTgxOTksImlhdCI6MTY2OTg5NDU5OSwianRpIjoiMTU1Zjg2YjItMjQ3Zi00NzAyLWE3YjItNjcxZjJjMzMwM2I2Iiwidmlld3MiOltdfQ.lLbn9BtgKvgAcb07if12SaEyPAKgXOEmr6x3Y5pU-vE",

"status":"INITIATED",

"consent_request_id":"bc0209bd-bdbe-4329-b953-d92d17d733f4"

}

3) We receive the SCA message via SMS

Your consent challenge : 29131491, Application: Any application

4) Call endpoint Answer Consent Challenge with logged on user

Url: https://apisandbox.openbankproject.com/obp/v5.0.0/banks/gh.29.uk.x/consents/155f86b2-247f-4702-a7b2-671f2c3303b6/challenge

Post body:

{

"answer": "29131491"

}

Output:

{

"consent_id":"155f86b2-247f-4702-a7b2-671f2c3303b6",

"jwt":"eyJhbGciOiJIUzI1NiJ9.eyJlbnRpdGxlbWVudHMiOlt7InJvbGVfbmFtZSI6IkNhbkdldEN1c3RvbWVyIiwiYmFua19pZCI6ImdoLjI5LnVrLngifV0sImNyZWF0ZWRCeVVzZXJJZCI6ImFiNjUzOWE5LWIxMDUtNDQ4OS1hODgzLTBhZDhkNmM2MTY1NyIsInN1YiI6IjU3NGY4OGU5LTE5NDktNDQwNy05NTMwLTA0MzM3MTU5YzU2NiIsImF1ZCI6IjFhMTA0NjNiLTc4NTYtNDU4ZC1hZGI2LTViNTk1OGY1NmIxZiIsIm5iZiI6MTY2OTg5NDU5OSwiaXNzIjoiaHR0cDpcL1wvMTI3LjAuMC4xOjgwODAiLCJleHAiOjE2Njk4OTgxOTksImlhdCI6MTY2OTg5NDU5OSwianRpIjoiMTU1Zjg2YjItMjQ3Zi00NzAyLWE3YjItNjcxZjJjMzMwM2I2Iiwidmlld3MiOltdfQ.lLbn9BtgKvgAcb07if12SaEyPAKgXOEmr6x3Y5pU-vE",

"status":"ACCEPTED"

}

5) Call endpoint Get Customer by CUSTOMER_ID with Consent Header

Request Header:

Consent-JWT:eyJhbGciOiJIUzI1NiJ9.eyJlbnRpdGxlbWVudHMiOlt7InJvbGVfbmFtZSI6IkNhbkdldEN1c3RvbWVyIiwiYmFua19pZCI6ImdoLjI5LnVrLngifV0sImNyZWF0ZWRCeVVzZXJJZCI6ImFiNjUzOWE5LWIxMDUtNDQ4OS1hODgzLTBhZDhkNmM2MTY1NyIsInN1YiI6IjU3NGY4OGU5LTE5NDktNDQwNy05NTMwLTA0MzM3MTU5YzU2NiIsImF1ZCI6IjFhMTA0NjNiLTc4NTYtNDU4ZC1hZGI2LTViNTk1OGY1NmIxZiIsIm5iZiI6MTY2OTg5NDU5OSwiaXNzIjoiaHR0cDpcL1wvMTI3LjAuMC4xOjgwODAiLCJleHAiOjE2Njk4OTgxOTksImlhdCI6MTY2OTg5NDU5OSwianRpIjoiMTU1Zjg2YjItMjQ3Zi00NzAyLWE3YjItNjcxZjJjMzMwM2I2Iiwidmlld3MiOltdfQ.lLbn9BtgKvgAcb07if12SaEyPAKgXOEmr6x3Y5pU-

Output:

{

"bank_id":"gh.29.uk.x",

"customer_id":"a9c8bea0-4f03-4762-8f27-4b463bb50a93",

"customer_number":"0908977830011-#2",

"legal_name":"NONE",

"mobile_phone_number":"+3816319549071",

"email":"marko@tesobe.com1",

"face_image":{

"url":"www.openbankproject",

"date":"2017-09-18T22:00:00Z"

},

"date_of_birth":"2017-09-18T22:00:00Z",

"relationship_status":"Single",

"dependants":5,

"dob_of_dependants":[],

"credit_rating":{

"rating":"3",

"source":"OBP"

},

"credit_limit":{

"currency":"EUR",

"amount":"10001"

},

"highest_education_attained":"Bachelor’s Degree",

"employment_status":"Employed",

"kyc_status":true,

"last_ok_date":"2017-09-18T22:00:00Z",

"title":null,

"branch_id":"3210",

"name_suffix":null,

"customer_attributes":[]

}

Consumer

The "consumer" of the API, i.e. the web, mobile or serverside "App" that calls on the OBP API on behalf of the end user (or system).

Each Consumer has a consumer key and secret which allows it to enter into secure communication with the API server.

A Consumer is given a Consumer ID (a UUID) which appears in logs and messages to the backend.

A Consumer may be pinned to an mTLS certificate i.e. the consumer record in the database is given a field which matches the PEM representation of the certificate.

After pinning, the consumer must present the certificate in all communication with the server.

There is a one to one relationship between a Consumer and its certificate. i.e. OBP does not (currently) store the history of certificates bound to a Consumer. If a certificate expires, the third party provider (TPP) must generate a new consumer using a new certificate. In this case, related resources such as rate limits and scopes must be copied from the old consumer to the new consumer. In the future, OBP may store multiple certificates for a consumer, but a certificate will always identify only one consumer record.

Consumer, Consent, Transport and Payload Security

Consumer, Consent, Transport and Payload Security with MTLS and JWS

This glossary item aims to give an overview of how the communication between an Application and the OBP API server is secured with Consents, Consumer records, MTLs and JWS.

It includes some implementation step notes for the Application developer.

The following components are required:

Consumer record

The Application must have an active API Consumer / Client record on the server.

MTLS

With Mutual TLS both the Consumer and the Server (OBP API) must use certificates.

JWS

The Request is signed by the Consumer with a JWS using the client certificate of the Consumer. Example: OBP-Hola private void requestIntercept

The Request is verified by the OBP API Server using the JWS provided by the Consumer. See OBP-API def verifySignedRequest

The Response is signed by the OBP API Server with a JWS. See OBP-API def signResponse

The Response is verified by the Client using the JWS provided by the OBP API Server. Example: OBP-Hola private void responseIntercept

Consent

The end user must give permission to the Application in order for the Application to see his/her account and transaction data.

In order to get an App / Consumer key

Sign up or login as a developer.

Register your App / Consumer HERE

Be sure to enter your Client Certificate in the above form. To create the user.crt file see HERE

Authenticate

To test the service your App will need to authenticate using OAuth2.

You can use the OBP Hola App as an example / starting point for your App.

Consumer.consumer_key (Consumer Key)

The client identifier issued to the client during the registration process. It is a unique string representing the registration information provided by the client.

At the time the consumer_key was introduced OAuth 1.0a was only available. The OAuth 2.0 counterpart for this value is client_id

Consumption Device (CD)

The Consumption Device is the device that helps the user consume the service. In the CIBA use case, the user is not necessarily in control of the CD. For example, the CD may be in the control of an RP agent (e.g. at a bank teller) or might be a device controlled by the RP (e.g. a petrol pump)|

Counterparty.counterpartyId

Example value: 9fg8a7e4-6d02-40e3-a129-0b2bf89de8uh

Description: The Counterparty ID used in URLs. This SHOULD NOT be a name of a Counterparty.

Counterparty.counterpartyName

Example value: John Smith Ltd.

Description: The name of a Counterparty. Ideally unique for an Account

Counterparty.isBeneficiary

Example value: false

Description: This is a boolean. True if the originAccount can send money to the Counterparty

Cross-Device Authorization

Cross-device authorization flows enable a user to initiate an authorization flow on one device

(the Consumption Device) and then use a second, personally trusted, device (Authorization Device) to

authorize the Consumption Device to access a resource (e.g., access to a service).

Two examples of popular cross-device authorization flows are:

- The Device Authorization Grant RFC8628

- Client-Initiated Backchannel Authentication CIBA

Customer

The legal entity that has the relationship to the bank. Customers are linked to Users via User Customer Links. Customer attributes include Date of Birth, Customer Number etc.

Customer.attributeId

Example value: 7uy8a7e4-6d02-40e3-a129-0b2bf89de8uh

Description: Customer attribute id

Customer.attributeId

Example value: 7uy8a7e4-6d02-40e3-a129-0b2bf89de8uh

Description: User attribute id

Customer.consumerId

Example value: 7uy8a7e4-6d02-40e3-a129-0b2bf89de8uh

Description: A non human friendly string that identifies the consumer. It is the app which calls the apis

Customer.customerAccountLinkId

Example value: xyz8a7e4-6d02-40e3-a129-0b2bf89de8uh

Description: A non human friendly string that identifies the Customer Account Link and is used in URLs.

Customer.customerAttributeId

Example value: 7uy8a7e4-6d02-40e3-a129-0b2bf89de8uh

Description: A non human friendly string that identifies the customer attribute and is used in URLs.

Customer.customerAttributeName

Example value: SPECIAL_TAX_NUMBER

Description: The Customer Attribute name, eg: SPECIAL_TAX_NUMBER

Customer.customerAttributeType

Example value: STRING

Description: It can be STRING, INTEGER, DOUBLE, DATE_WITH_DAY

Customer.customerAttributeValue

Example value: 123456789

Description: The Customer Attribute value of the current attribute type, eg: 123456789.

Customer.customerId

Example value: 7uy8a7e4-6d02-40e3-a129-0b2bf89de8uh

Description: A non human friendly string that identifies the customer and is used in URLs. This SHOULD NOT be the customer number. The combination of customerId and bankId MUST be unique on an OBP instance. customerId SHOULD be unique on an OBP instance. Ideally customerId is a UUID. A mapping between customer number and customer id is kept in OBP.

Customer.customerNumber

Example value: 5987953

Description: The human friendly customer identifier that MUST uniquely identify the Customer at the Bank ID. Customer Number is NOT used in URLs.

Customer.customer_id

The identifier that MUST NOT leak the customer number or other identifier nomrally used by the customer or bank staff. It SHOULD be a UUID and MUST be unique in combination with BANK_ID.

Example value: 7uy8a7e4-6d02-40e3-a129-0b2bf89de8uh

Customer.key

Example value: bwf0ykmwoirip1yjxcn15wnhuyxcziwgtcoaildq

Description: This key should be used with Adapter.value together. They are a pair.

Customer.kycStatus

Example value: false

Description: This is boolean to indicate if the cusomter's KYC has been checked.

Customer.mobileNumber

Example value: +44 07972 444 876

Description: The mobile number name of the Customer.

Customer.secret

Example value: xwdgylv3vau0n2gkxu1aize4glapftfldp5y1bic

Description: This key should be used with Adapter.value together. They are a pair.

DAuth

DAuth Introduction, Setup and Usage

DAuth is an experimental authentication mechanism that aims to pin an ethereum or other blockchain Smart Contract to an OBP "User".

In the future, it might be possible to be more specific and pin specific actors (wallets) that are acting within the smart contract, but so far, one smart contract acts on behalf of one User.

Thus, if a smart contract "X" calls the OBP API using the DAuth header, OBP will get or create a user called X and the call will proceed in the context of that User "X".

DAuth is invoked by the REST client (caller) including a specific header (see step 3 below) in any OBP REST call.

When OBP receives the DAuth token, it creates or gets a User with a username based on the smart_contract_address and the provider based on the network_name. The combination of username and provider is unique in OBP.

If you are calling OBP-API via an API3 Airnode, the Airnode will take care of constructing the required header.

When OBP detects a DAuth header / token it first checks if the Consumer is allowed to make such a call. OBP will validate the Consumer ip address and signature etc.

Note: The DAuth flow does not require an explicit POST like Direct Login to create the token.

Permissions may be assigned to an OBP User at any time, via the UserAuthContext, Views, Entitlements to Roles or Consents.

Note: DAuth is NOT enabled on this instance!

Note: The DAuth client is responsible for creating a token which will be trusted by OBP absolutely!

To use DAuth:

1) Configure OBP API to accept DAuth.

Set up properties in your props file

# -- DAuth --------------------------------------

# Define secret used to validate JWT token

# jwt.public_key_rsa=path-to-the-pem-file

# Enable/Disable DAuth communication at all

# In case isn't defined default value is false

# allow_dauth=false

# Define comma separated list of allowed IP addresses

# dauth.host=127.0.0.1

# -------------------------------------- DAuth--

Please keep in mind that property jwt.public_key_rsa is used to validate JWT token to check it is not changed or corrupted during transport.

2) Create / have access to a JWT

The following videos are available:

* DAuth in local environment

HEADER:ALGORITHM & TOKEN TYPE

{

"alg": "RS256",

"typ": "JWT"

}

PAYLOAD:DATA

{

"smart_contract_address": "0xe123425E7734CE288F8367e1Bb143E90bb3F051224",

"network_name": "AIRNODE.TESTNET.ETHEREUM",

"msg_sender": "0xe12340927f1725E7734CE288F8367e1Bb143E90fhku767",

"consumer_key": "0x1234a4ec31e89cea54d1f125db7536e874ab4a96b4d4f6438668b6bb10a6adb",

"timestamp": "2021-11-04T14:13:40Z",

"request_id": "0Xe876987694328763492876348928736497869273649"

}

VERIFY SIGNATURE

RSASHA256(

base64UrlEncode(header) + "." +

base64UrlEncode(payload),

) your-RSA-key-pair

Here is an example token:

eyJhbGciOiJIUzI1NiIsInR5cCI6IkpXVCJ9.eyJzbWFydF9jb250cmFjdF9hZGRyZXNzIjoiMHhlMTIzNDI1RTc3MzRDRTI4OEY4MzY3ZTFCYjE0M0U5MGJiM0YwNTEyMjQiLCJuZXR3b3JrX25hbWUiOiJFVEhFUkVVTSIsIm1zZ19zZW5kZXIiOiIweGUxMjM0MDkyN2YxNzI1RTc3MzRDRTI4OEY4MzY3ZTFCYjE0M0U5MGZoa3U3NjciLCJjb25zdW1lcl9rZXkiOiIweDEyMzRhNGVjMzFlODljZWE1NGQxZjEyNWRiNzUzNmU4NzRhYjRhOTZiNGQ0ZjY0Mzg2NjhiNmJiMTBhNmFkYiIsInRpbWVzdGFtcCI6IjIwMjEtMTEtMDRUMTQ6MTM6NDBaIiwicmVxdWVzdF9pZCI6IjBYZTg3Njk4NzY5NDMyODc2MzQ5Mjg3NjM0ODkyODczNjQ5Nzg2OTI3MzY0OSJ9.XSiQxjEVyCouf7zT8MubEKsbOBZuReGVhnt9uck6z6k

3) Try a REST call using the header

Using your favorite http client:

GET https://apisandbox.openbankproject.com/obp/v3.0.0/users/current

Body

Leave Empty!

Headers:

DAuth: your-jwt-from-step-above

Here is it all together:

GET https://apisandbox.openbankproject.com/obp/v3.0.0/users/current HTTP/1.1

Host: localhost:8080

User-Agent: curl/7.47.0

Accept: /

DAuth: eyJhbGciOiJIUzI1NiIsInR5cCI6IkpXVCJ9.eyJzbWFydF9jb250cmFjdF9hZGRyZXNzIjoiMHhlMTIzNDI1RTc3MzRDRTI4OEY4MzY3ZTFCYjE0M0U5MGJiM0YwNTEyMjQiLCJuZXR3b3JrX25hbWUiOiJFVEhFUkVVTSIsIm1zZ19zZW5kZXIiOiIweGUxMjM0MDkyN2YxNzI1RTc3MzRDRTI4OEY4MzY3ZTFCYjE0M0U5MGZoa3U3NjciLCJjb25zdW1lcl9rZXkiOiIweDEyMzRhNGVjMzFlODljZWE1NGQxZjEyNWRiNzUzNmU4NzRhYjRhOTZiNGQ0ZjY0Mzg2NjhiNmJiMTBhNmFkYiIsInRpbWVzdGFtcCI6IjIwMjEtMTEtMDRUMTQ6MTM6NDBaIiwicmVxdWVzdF9pZCI6IjBYZTg3Njk4NzY5NDMyODc2MzQ5Mjg3NjM0ODkyODczNjQ5Nzg2OTI3MzY0OSJ9.XSiQxjEVyCouf7zT8MubEKsbOBZuReGVhnt9uck6z6k

CURL example

curl -v -H 'DAuth: eyJhbGciOiJIUzI1NiIsInR5cCI6IkpXVCJ9.eyJzbWFydF9jb250cmFjdF9hZGRyZXNzIjoiMHhlMTIzNDI1RTc3MzRDRTI4OEY4MzY3ZTFCYjE0M0U5MGJiM0YwNTEyMjQiLCJuZXR3b3JrX25hbWUiOiJFVEhFUkVVTSIsIm1zZ19zZW5kZXIiOiIweGUxMjM0MDkyN2YxNzI1RTc3MzRDRTI4OEY4MzY3ZTFCYjE0M0U5MGZoa3U3NjciLCJjb25zdW1lcl9rZXkiOiIweDEyMzRhNGVjMzFlODljZWE1NGQxZjEyNWRiNzUzNmU4NzRhYjRhOTZiNGQ0ZjY0Mzg2NjhiNmJiMTBhNmFkYiIsInRpbWVzdGFtcCI6IjIwMjEtMTEtMDRUMTQ6MTM6NDBaIiwicmVxdWVzdF9pZCI6IjBYZTg3Njk4NzY5NDMyODc2MzQ5Mjg3NjM0ODkyODczNjQ5Nzg2OTI3MzY0OSJ9.XSiQxjEVyCouf7zT8MubEKsbOBZuReGVhnt9uck6z6k' https://apisandbox.openbankproject.com/obp/v3.0.0/users/current

You should receive a response like:

{

"user_id": "4c4d3175-1e5c-4cfd-9b08-dcdc209d8221",

"email": "",

"provider_id": "0xe123425E7734CE288F8367e1Bb143E90bb3F051224",

"provider": "ETHEREUM",

"username": "0xe123425E7734CE288F8367e1Bb143E90bb3F051224",

"entitlements": {

"list": []

}

}

Under the hood

The file, dauth.scala handles the DAuth,

We:

-> Check if Props allow_dauth is true

-> Check if DAuth header exists

-> Check if getRemoteIpAddress is OK

-> Look for "token"

-> parse the JWT token and getOrCreate the user

-> get the data of the user

More information

Parameter names and values are case sensitive.

Each parameter MUST NOT appear more than once per request.

Data Model Overview

An overview of the Open Bank Project Data Model.

This diagram may help in understanding the Open Bank Project entities, capabilities and concepts. However, it is subject to change. If we change the data model, we release migration scripts.

Direct Login

Direct Login is a simple authentication process to be used at hackathons and trusted environments:

1) Get your App key

Sign up or login as a developer.

Register your App key HERE

Copy and paste the consumer key for step two below.

2) Authenticate

Using your favorite http client:

POST https://apisandbox.openbankproject.com/my/logins/direct

Body

Leave Empty!

Headers:

Content-Type: application/json

directlogin: username=janeburel,

password=the-password-of-jane,

consumer_key=your-consumer-key-from-step-one

Here is it all together:

POST https://apisandbox.openbankproject.com/my/logins/direct HTTP/1.1

directlogin: username=janeburel, password=686876, consumer_key=GET-YOUR-OWN-API-KEY-FROM-THE-OBP

Content-Type: application/json

Host: 127.0.0.1:8080

Connection: close

User-Agent: Paw/2.3.3 (Macintosh; OS X/10.11.3) GCDHTTPRequest

Content-Length: 0

Note: HTTP/2.0 requires that header names are lower case. Currently the header name for directlogin is case insensitive.

To troubleshoot request headers, you may want to ask your administrator to Echo Request headers.

You should receive a token:

{"token":"a-long-token-string"}

3) Make authenticated API calls

In subsequent calls you can use the token received in step 2

e.g.

Action:

PUT https://apisandbox.openbankproject.com/obp/v2.0.0/banks/obp-bankx-n/accounts/my-new-account-id

Body:

{ "type":"CURRENT", "balance":{ "currency":"USD", "amount":"0" }}

Headers:

Content-Type: application/json

directlogin: token=your-token-from-step-2

Here is another example:

PUT https://apisandbox.openbankproject.com/obp/v2.0.0/banks/enbd-egy--p3/accounts/newaccount1 HTTP/1.1

directlogin: token=eyJhbGciOiJIUzI1NiIsInR5cCI6IkpXVCJ9.eyIiOiIifQ.C8hJZNPDI59OOu78pYs4BWp0YY_21C6r4A9VbgfZLMA

Content-Type: application/json

Cookie: JSESSIONID=7h1ssu6d7j151u08p37a6tsx1

Host: 127.0.0.1:8080

Connection: close

User-Agent: Paw/2.3.3 (Macintosh; OS X/10.11.3) GCDHTTPRequest

Content-Length: 60

{"type":"CURRENT","balance":{"currency":"USD","amount":"0"}}

More information

Parameter names and values are case sensitive.

The following parameters must be sent by the client to the server:

username

The name of the user to authenticate.

password

The password used to authenticate user. Alphanumeric string.

consumer_key

The application identifier. Generated on OBP side via

https://apisandbox.openbankproject.com/consumer-registration endpoint.

Each parameter MUST NOT appear more than once per request.

Dummy Customer Logins

The following dummy Customer Logins may be used by developers testing their applications on this sandbox:

Customer LoginsTODO we should be able to put markdown here and have it rendered as such in the glossary

https://github.com/OpenBankProject/OBP-API/wiki#customer-logins

Dynamic Endpoint Manage

If you want to create endpoints from Swagger / Open API specification files, use Dynamic Endpoints.

We use the term "Dynamic" because these Endpoints persist in the OBP database and are served from real time generated Scala code.

This contrasts to the "Static" endpoints (see the Static glossary item) which are served from static Scala code.

Dynamic endpoints can be changed in real-time and do not require an OBP instance restart.

When you POST a swagger file, all the endpoints defined in the swagger file, will be created in this OBP instance.

You can create a set of endpoints in three different modes:

1) If the host field in the Swagger file is set to "dynamic_entity", then you should link the swagger JSON fields to Dynamic Entity fields. To do this use the Endpoint Mapping endpoints.

2) If the host field in the Swagger file is set to "obp_mock", the Dynamic Endpoints created will return example responses defined in the swagger file.

3) If you need to link the responses to external resource, use the Method Routing endpoints.

Dynamic Endpoints can be created at the System level (bank_id is null) or Bank / Space level (bank_id is NOT null).

You might want to create Bank level Dynamic Entities in order to grant automated roles based on user email domain. See the OBP-API sample.props.template

Upon the successful creation of each Dynamic Endpoint, OBP will automatically:

*Create a Guard with a named Role on the Endpoint to protect it from unauthorised users.

*Grant you an Entitlement to the required Role so you can call the endpoint and pass its Guard.

The following videos are available:

Dynamic Entity Manage

Dynamic Entities can be used to store and retrieve custom data objects (think your own tables and fields) in the OBP instance.

You can define your own Dynamic Entities or use Dynamic Entities created by others.

You would use Dynamic Entities if you want to go beyond the OBP standard data model and store custom data structures. Note, if you want to extend the core OBP banking model of Customers, Products, Accounts, Transactions and so on you can also add Custom Attributes to these standard objects.

You would use Dynamic Endpoints if you want to go beyond the standard OBP or other open banking standard APIs.

Dynamic Entities have their own REST APIs so you can easily Create, Read, Update and Delete records. However, you can also connect Dynamic Endpoints with your own API definitions (via Swagger) and so create custom GET endpoints connecting to any combination of Dynamic Entities.

Dynamic Endpoints can retrieve the data of Dynamic Entities so you can effectively create bespoke endpoint / data combinations - at least for GET endpoints - using Dynamic Endpoints, Entities and Endpoint Mapping.

In order to use Dynamic Entities you will need to have the appropriate Entitlements to Create, Read, Update or Delete records in the Dynamic Entity.

You define your Dynamic Entities in JSON.

Fields are typed, have an example value and a (markdown) description. They can also be constrained in size.

You can also create field "references" to other fields in other Entities. These are like foreign keys to other Dynamic or Static (built in) entities.

In other words, if you create an Entity called X which has a field called A, you can force the values of X.A to match the values of Y.B where Y is another Dynamic Entity or Z.B where Z is a Static (OBP) Entity.

If you want to add data to an existing Entity, you can create a Dynamic Entity which has a reference field to the existing entity.

Dynamic Entities can be created at the System level (bank_id is null) - or Bank / Space level (bank_id is not null). You might want to create Bank level Dynamic Entities in order to grant automated roles based on user email domain.

When creating a Dynamic Entity, OBP automatically:

- Creates a data structure in the OBP database in which to store the records of the new Entity.

- Creates a primary key for the Entity which can be used to update and delete the Entity.

- Creates Create, Read, Update and Delete endpoints to operate on the Entity so you can insert, get, modify and delete records. These CRUD operations are all available over the generated REST endpoints.

- Creates Roles to guard the above endpoints.

Following the creation of a Dynamic Entity you will need to grant yourself or others the appropriate roles before you can insert or get records.

The generated Roles required for CRUD operations on a Dynamic Entity are like any other OBP Role i.e. they can be requested, granted, revoked and auto-granted using the API Explorer / API Manager or via REST API. To see the Roles required for a Dynamic Entities endpoints, see the API Explorer for each endpoint concerned.

Each Dynamic Entity gets a dynamicEntityId which uniquely identifies it and also the userId which identifies the user who created the Entity. The dynamicEntityId is used to update the definition of the Entity.

To visualise any data contained in Dynamic Entities you could use external BI tools and use the GET endpoints and authenticate using OAuth or Direct Login.

The following videos are available:

Dynamic Message Doc

In OBP we represent messages sent by a Connector method / function as MessageDocs.